Licensed Mortgage Loan Officer in Utah and Colorado

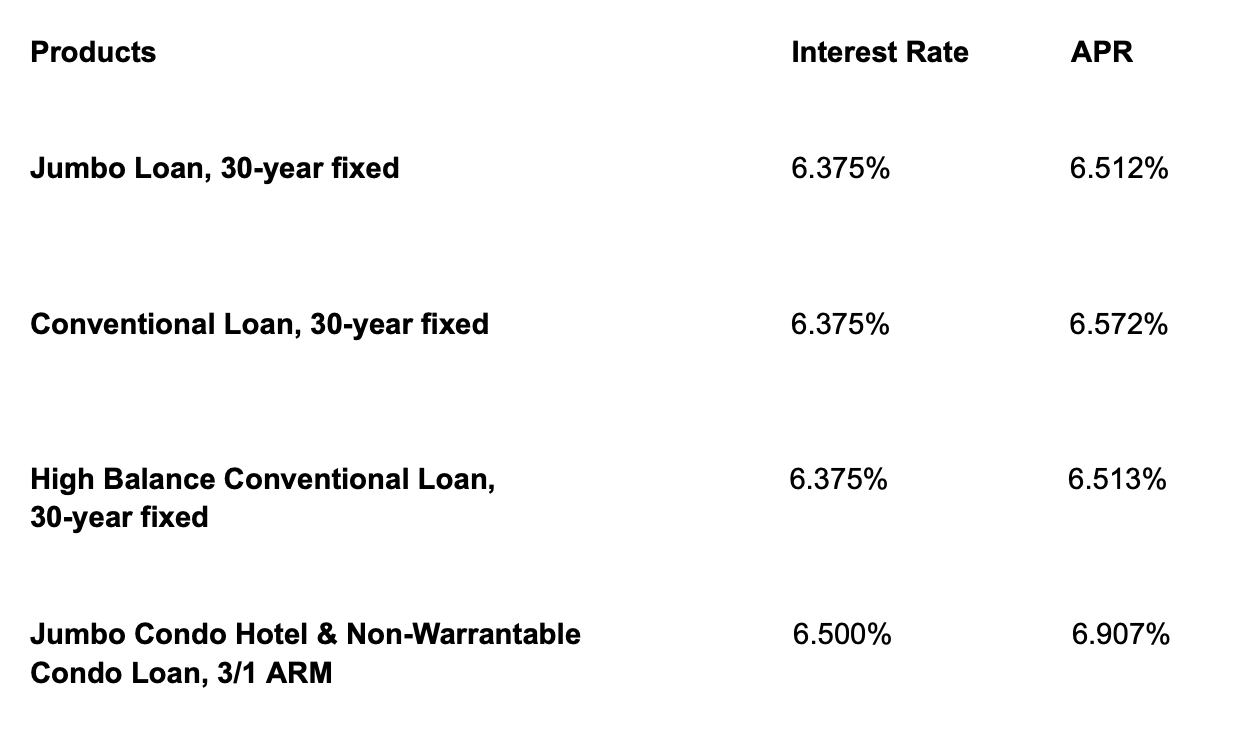

Rates as of 07/08/25

Loan Products

Jumbo Loans

We offer competitively priced jumbo loans up to $5,000,000 with as little as 20% down for primary residences or second/vacation homes.

Construction Loans

Construction loans can be completed as a one time close loan for primary residences or second/vacation homes. These loan amounts are available up to $3,000,000.

Construction term is up to 24 months with interest only payments.

80% financing allowed based on appraised value - lot equity can be used for 20% equity requirement

Spec construction loans are also available - please contact Potter for additional information.

Condo Loans

Condo hotels, non warrantable, and warrantable condo loans.

Condos require property approval and several factors can deem a condo not eligible for conventional financing.

We have a wide variety of condo loans available for all condo property types and I am an expert lender in this area.

Portfolio Loans

These are unique loans that many lenders do not offer. Our preferred relationships with investors allow us to offer these loans up to $3 million. Portfolio loans are a great option if the borrower is complex or the property is unique.

Bridge Loans

Bridge loans allow you to purchase a new home while your current home is listed for sale. These are a great options for borrowers with significant equity in their departing residence.

Non Qualified Mortgages

These loan products are commonly referred to as Non-QM loans. They are a great option for investors who own rental properties, self employed borrowers, and foreign nationals.

Conventional Loans

We work with some of the largest investors for conventional loans which allow us to differentiate our product offerings.

In Summit and Wasatch Counties of Utah the current loan limit for 2025 is $1,149,825 which can be done with as little as 5% down.

Temporary Rate Buy Downs and Adjustable Rate Mortgages are also available on conventional loans.

Government Loans

VA Loans offer up to 100% financing for active or retired military members.

USDA loans offer 100% financing for properties in rural areas. Income limits and household size are a factor in the amount available.

FHA loans offer financing with as little as 3.5% down.

Meet Potter

With 19 years of lending experience, Potter is well versed in the Park City real estate market. Being fortunate enough to grow up in this beautiful town, he has seen the area grow into a world class resort destination. He received a degree in Economics from Chapman University in Orange, CA and began his professional career in commercial finance. Prior to working at Intermountain Mortgage Company, Potter was a Vice President at a large regional bank in California. Now, he is back to working in the community he loves and helping people finance their dream of owning a home here. Potter is an avid skier, loves the outdoors, enjoys golf, fly fishing, and mountain biking.

Intermountain Mortgage Co.

Intermountain Mortgage Co. has been locally owned and operated in Park City, Utah since 1992. We are a direct lender with nationwide lending sources which allows us to offer a wide variety of competitively priced loan products.

We have over 200 five star Google ratings and have been ranked as “Park City’s Best” mortgage company for several, consecutive years.

Our product offering is some of the best in the industry. We offer loans ranging from construction loans to condo hotel loans including many other products such as refinance loans, jumbo loans, relocation loans, second home loans, and investment property loans, along with conventional loans, and government loans offering up to 100% financing.

Reviews

"I had the pleasure to work with Potter Clark at Intermountain Mortgage on a recent purchase outside Park City, UT. Potter is knowledgeable, efficient, responsive and a pleasure to work with, making the mortgage process as simple and effortless as possible. I would be happy to engage with Potter and Intermountain in the future."

— Greig P.

“I have done two purchase loans with Intermountain, and both have been extremely smooth. Potter and his team were extremely responsive, accurate, and professional in my most recent transaction. In addition, they facilitated a loan at a great rate that other brokers said would be very challenging."

— Bradley L.

“I worked with Potter Clark in the mortgage process and he was very professional and helpful. He went out of his way to make sure that everything went smoothly. Definitely did not disappoint.”

— Susan T.

“There is no better experience and customer service then utilizing Intermountain Mortgage and specifically Potter Clark. When we purchased our home in 2023 we had challenges with our loan just like most and Potter came to the table with solutions and a trustworthy position that you can't replace with other agents out there in Park City.”

— Chris G.

This is an advertisement for mortgage loans in Utah and Colorado, and all loans are subject to approval. Additional underwriting guidelines are required to qualify for the loans advertised. Programs, terms, rates, and APR are subject to change without notice. Certain assumptions are made for this advertisement, and not all borrowers will qualify for the loans advertised. Advertised programs, rates, and APR are available as of the date noted on this website. Rates and APR are floating until a completed application has been received and the rate has been locked. Rates are based on a purchase of a primary residence at 70% LTV with credit scores above 780 with the property as a single-family home with the property exception of the jumbo condo hotel and non-warrantable condo loan product. The information contained in this advertisement is subject to change without notice and is non-binding.